Secondary Pensions – Where are we now!

In February 2020, the States approved proposals for the establishment of a secondary pension scheme. This created a requirement for occupational pensions to be offered to most employed people and it was initially intended that the proposals would be phased in from 2022. The approach is similar to the UK Government’s establishment of auto-enrolment in workplace pension schemes.

The aim of the Secondary Pension scheme is to encourage people of working age to save more for their retirement so that they won’t have to rely solely on the States old age pension and tax-funded welfare benefits later in life.

The date for the scheme coming into force has been pushed back to 1 January 2023 due to the originally chosen provider of the scheme having pulled out. The Committee for Employment & Social Security have begun the tender process once more with local providers.

Once in force, employers will have a legal duty to enrol their employees automatically into the new secondary pension scheme, or into another qualifying scheme. However, it is not compulsory for individuals and one can opt out of the scheme. If employees do chose to opt-out, employers will be required to re-enrol them into the pension scheme every three years – it may be that circumstances have changed and the employee may now want to remain in the scheme at that time, but they can choose to opt-out again.

There will be no requirement for self-employed and non-employed individuals to be enrolled onto the scheme, but they will be able to contribute voluntarily.

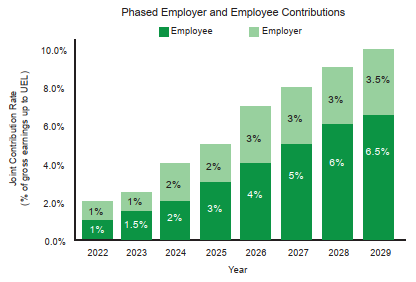

Employers will be required to contribute at least minimum levels into either a qualifying pension scheme or into the new secondary pension scheme following automatic enrolment of their employees. The contribution requirements are to be phased in from 1% to 3.5% of earnings over 7 years.

The requirement for employers to provide access to a pension scheme will be dependent on the number of employees as follows:

| Employees | Deadline |

| 26 + | 1 January 2023 |

| 11 – 25 | 1 April 2023 |

| 6 – 10 | 1 July 2023 |

| 2 – 5 | 1 January 2024 |

| 1 | 1 April 2024 |

Employers would not have an obligation to make contributions for individuals who have opted out of the new scheme. If employers already contribute to a qualifying pension scheme for their employees then they will not have to contribute to the new secondary pension scheme as well, although they would be able to switch if they wished to do so.

How can we help!

Focus have many years of payroll and benefits administration experience. We have helped clients to create tailored solutions for their employees through our network of providers and can assist with ongoing benefits management and employer processes such as enrolling new employees, liaising with providers, such as BWCI, and through our payroll services make payments directly into employer pensions.

We have been working with BWCI for some time now, who have been providing pension solutions to local Employers for over 40 years and provide a range of local, highly personalised, cost effective pension solutions to meet your requirements. They can offer:

- A complete local solution through one of our existing qualifying pension products.

- Flexible solutions for all companies; large, small, commercial and finance sector.

- Bespoke solutions for companies with complex needs.

- Advice on how to make your existing pension arrangements meet secondary pensions requirements

Employers are urged to get in touch to begin planning and getting ready for Secondary pensions now to ensure compliance by 1 January 2023.