Focus invited John Martin, Partner, BWCI to share his thoughts on the forthcoming Secondary Pension Scheme arrangements that will affect all employers.

It is highly recommended that employers with current pension arrangements and those who may not have an employee pension in place, begin considering and preparing for these legislative changes in Guernsey.

What’s changing?

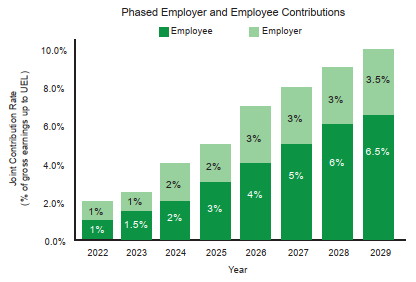

From 2022, Employers will need to automatically enrol their Eligible Employees and pay minimum contributions (see graph for details) into a Qualifying Pension Scheme. Nearly all Guernsey and Alderney employees will be Eligible Employees. The approach is similar to the UK Government’s establishment of auto-enrolment in workplace pension schemes.

This is expected to be effective initially for Employers with more than 26 employees and with a later phased introduction depending on the number of employees each Employer has.

What does this mean for my business?

Some Employers may already have their own pension scheme, pay contributions into a pension arrangement which each employee selects, pays cash on top of basic salary or have no pension arrangement at all. All Employers will potentially be affected.

In addition, there may be implications for contracts of employment and your payroll (if you have not outsourced this).

Overall, many Employers are already planning or in the process of getting ready for Secondary pensions now.

How can BWCI help?

BWCI have been providing pension solutions to local Employers for over 40 years and provide a range of local, highly personalised, cost effective pension solutions to meet your requirements. We can offer:

- A complete local solution through one of our existing qualifying pension products.

- Flexible solutions for all companies; large, small, commercial and finance sector.

- Bespoke solutions for companies with complex needs.

- Advice on how to make your existing pension arrangements meet secondary pensions requirements.

How can Focus help?

Focus HR have many years of payroll and benefits administration experience. We have helped clients to create tailored solutions for their employees through our network of providers and can assist with ongoing benefits management and employer processes such as enrolling new employees, liaising with providers, such as BWCI, and through our payroll services make payments directly into employer pensions.

Contact Details

For more information and to discuss your requirements contact

John Martin by email or call 01481 728 432

The Focus HR team by email or call 728 824